News

Read the latest news from Gentoo.

We're supporting ASB Awareness Week 2025

We are proud to support ASB Awareness Week 2025, a national campaign running from 30 June to 4 July that encourages communities to take a stand against anti-social behaviour (ASB) and raise awareness of the support available.

As a housing provider to over 60,000 people in Sunderland,......

Gentoo strengthens Property Investment team with new senior appointments

We have strengthened our Property Investment team with new senior appointments....

Ready, Set, Grow! Win prizes in our annual gardening competition

We’re excited to invite green-fingered enthusiasts across Wearside to take part in our gardening ...

We’re hitting the road with a new mobile housing hub to bring services direct to customers

We have launched a brand-new mobile housing hub designed to bring services directly to customers ...

We're investing £44 million to improve more than 4,000 homes in Sunderland

We've announced one of the largest investment programmes in Sunderland, which will see more than ...

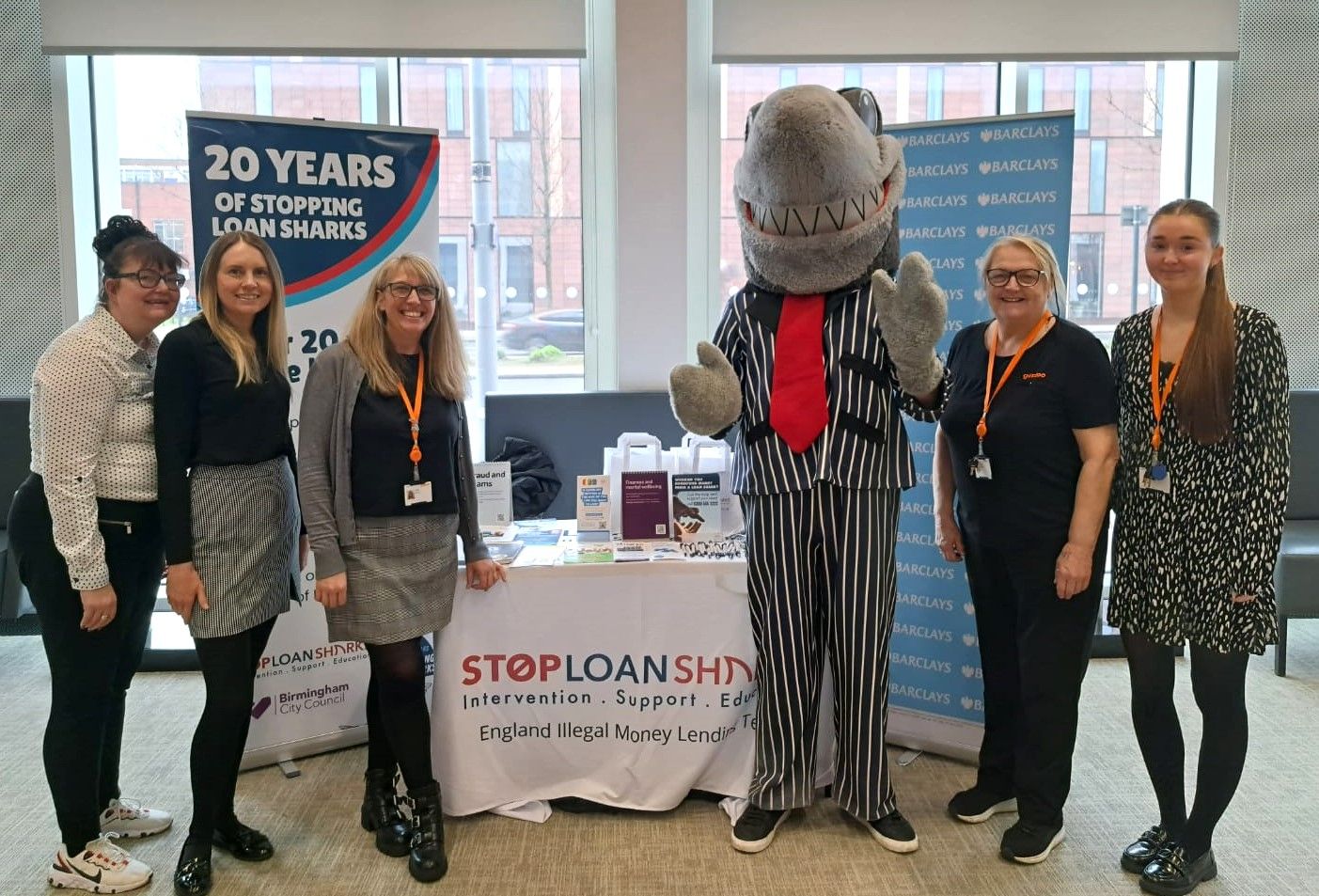

We've been recognised for raising awareness of the dangers of using loan sharks

We ha...

More than 1500 customers hop into Easter fun at Family Fun Day

Thanks to a partnership with The Foundation of Light, more than 1500 customers enjoyed a free Eas...